OPay is a mobile-based payment platform that allows you to make transactions, pay bills, buy airtime and data, order food and groceries, and access other services in a fast and convenient way. OPay is owned by Opera, a popular browser company, and it was launched in Nigeria in 2018. Since then, it has expanded to other African countries and has gained millions of users who trust it with their money. In this blog post, I will show you how to open an OPay account and enjoy its benefits.

Why You Should Open an OPay Account

There are many reasons why you should open an OPay account. Here are some of them:

- OPay is easy to use. You can download the app from Google Play Store or Apple App Store, or visit the website and create an account with just your phone number, NIN, BVN or other valid IDs.

- OPay is secure. Your data is stored and encrypted using strong cryptography, and the platform is compliant with PCI DSS. Your transactions are always encrypted and secured.

- OPay is cheap. You can enjoy discounts and cashbacks when you use OPay to pay for services or buy products. You can also avoid charges that banks and other platforms impose on you.

- OPay is versatile. You can use OPay for a variety of purposes, such as paying for electricity bills, TV subscriptions, WAEC fees, hotel and flight bookings, governmental payments, university tuition fees, and more. You can also use OPay to fund your Bet9ja account, your Cowry Card, or your microfinance bank account2.

- OPay is rewarding. You can access OKash loans from OPay with low interest rates and flexible repayment terms. You can also earn commissions by becoming an OPay agent or referring others to join the platform.

How to Open an OPay Account

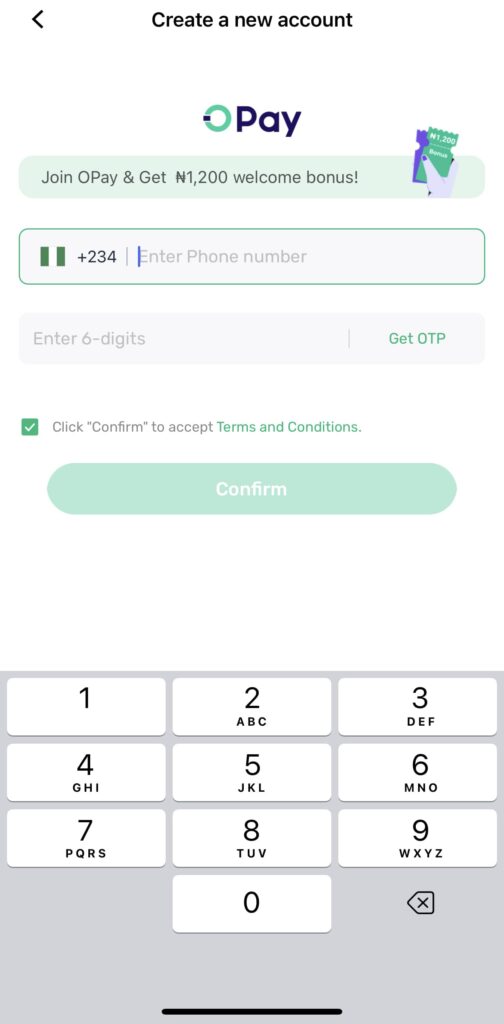

To open an OPay account, you need to follow these simple steps:

- Download the OPay app from Google Play Store or Apple App Store, or visit the website.

- Open the app or the website and click on “Create a new account”.

- Enter your mobile number and verify it with the OTP sent to you.

- Set a six-digit PIN for your account security.

- Complete your profile by entering your name, email address, NIN, BVN or other valid IDs.

- Congratulations! You have successfully opened an OPay account.

How to Fund Your OPay Account

To fund your OPay account, you have several options:

- You can link your debit card to your OPay account and use it to top up your balance.

- You can transfer money from your bank account to your OPay account using the USSD code *955# or the app.

- You can deposit cash at any OPay agent near you using the QR code or the phone number.

- You can receive money from other OPay users by giving them your phone number or QR code.

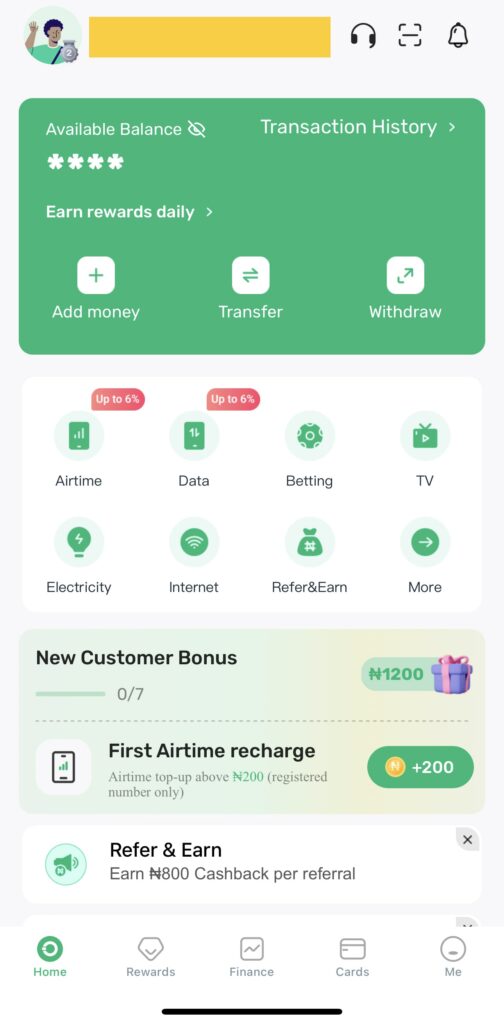

How to Use Your OPay Account

To use your OPay account, you can explore the various services and features available on the app or the website. Here are some examples:

- To pay for electricity bills, go to “Services” and select “Electricity”. Choose your distribution company, enter your meter number and amount, and confirm the payment.

- To pay for TV subscriptions, go to “Services” and select “TV”. Choose your provider, enter your smart card number and amount, and confirm the payment.

- To buy airtime or data, go to “Airtime/Data” and select your network. Enter your phone number and amount, and confirm the payment.

- To order food or groceries, go to “Food/Grocery” and browse the available restaurants or stores. Select your items, add them to your cart, enter your delivery address and confirm the order.

- To access OKash loans, go to “OKash” and apply for a loan. Enter your loan amount and duration, agree to the terms and conditions, and submit your application. If approved, you will receive the money in your OPay account instantly.

Conclusion

OPay is a mobile-based payment platform that offers you convenience, security, affordability, versatility, and rewards. You can open an OPay account with just your phone number, NIN, BVN or other valid IDs in minutes. You can fund your OPay account with various methods and use it for various purposes. You can also access OKash loans from OPay with low interest rates and flexible repayment terms. If you want to enjoy these benefits and more, open an OPay account today. You can also read our open overview here.